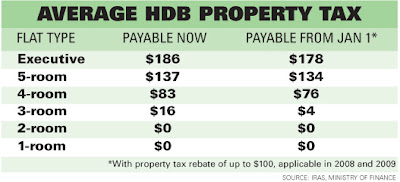

If you live in your flat your flat will be taxed at the substantially lower owner occupier tax rates for owner occupied hdb flats you need not pay tax on the first 8 000 of the av from 2014.

Hdb 5 room flat annual value.

According to the ministry of manpower mom and central provident fund board cpfb the 13 000 threshold should cover all hdb flats as well as some smaller private residences.

The 5 room hdb flats are great for larger households of 4 to 5 members with room enough for extended family.

In other words most self employed individuals in hdb flats even bigger ones will most likely be eligible for the recently announced self employed person income relief scheme sirs which excludes individuals whose homes annual value exceed 13 000.

5 room hdb flats consists of 3 bedrooms 1 of which is a master bedroom with attached bathroom.

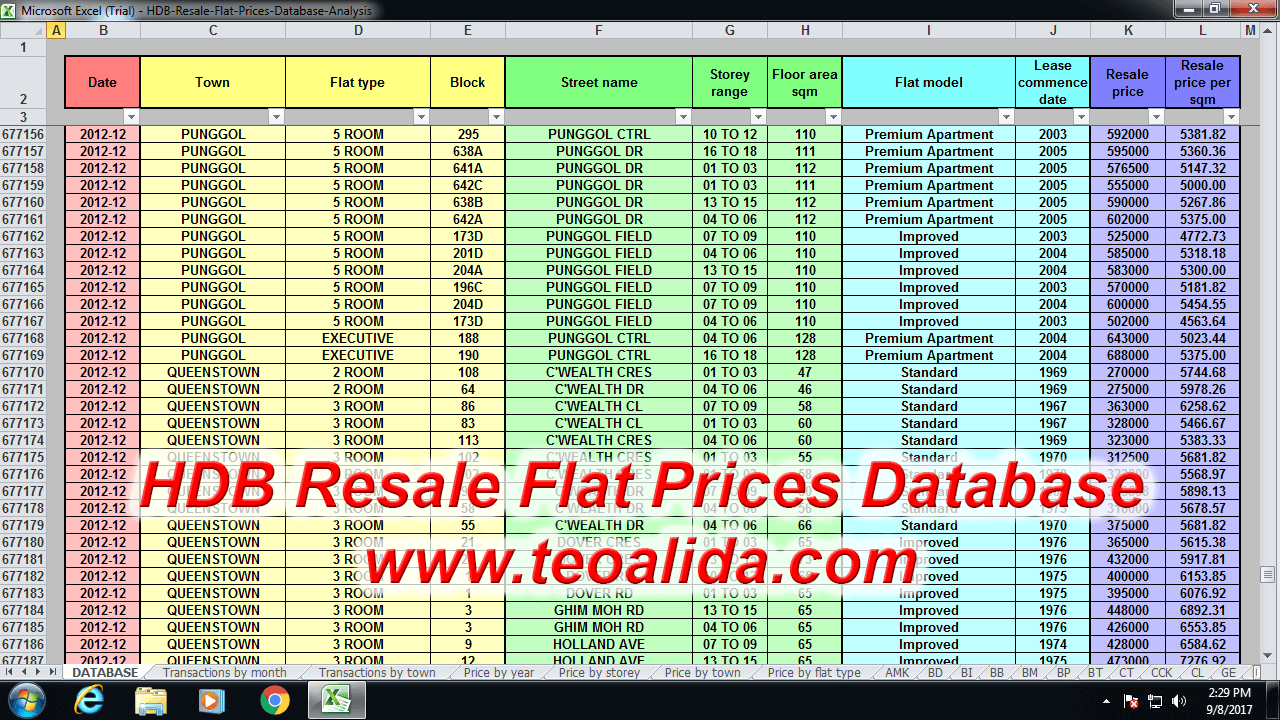

Resale transacted prices within 200 metres from any hdb block or dbss site project resale transacted prices for all flat types in each block all other related information to the block eip spr quota upgrading programmes and distance enquiry for cpf housing grant.

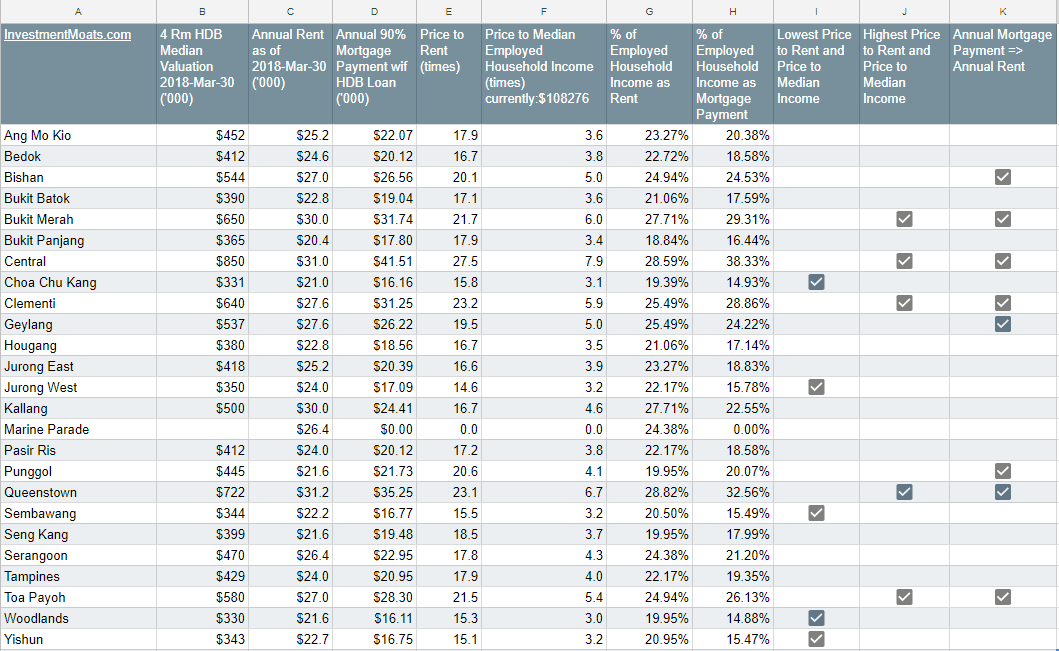

An av of between 6 000 and 10 000 will cover most of those staying in 5 room hdb flats and less valuable private properties.

The check annual value of property is an online service that you may use to search the annual value and the name s of owner s of a property.

Based on government data the median av of all hdb flats in singapore is 9 600 in 2018.

An av of 6 000 or less will cover all those who stay in a 1 2 3 room hdb flat and almost everyone who stays in a 4 room hdb flat.

The property tax is calculated by multiplying the annual value av of the property with the prevailing property tax rate.

A 5 room flat includes kitchen living dining area common bathroom service yard and.

Here s how its calculated and why it matters.

The threshold is regularly reviewed to ensure that it continues to maintain a similar coverage.

The owner of a property can find the current av of his properties at no cost by logging into mytax iras gov sg the owner does not need to use the check annual value of.

Such as deciding between renting a small room in a landed property or renting hdb room for the same price.

The av is not set in.

How to appeal against the annual value av property valuation from iras.

You can find out the annual value of the current year and up to past five years.

Hdb annual value av of your residential property.

The av threshold of 21 000 covers all hdb flats and some lower value private properties as the gst voucher targets those who are less well off.

Here s a breakdown by property size and type.